Infographic Instant With Bryane Michael

- Autor: Vários

- Narrador: Vários

- Editora: Podcast

- Duração: 29:11:02

- Mais informações

Informações:

Sinopse

Infographic Instant Audio provides the latest thinking in law, economics and business. Are you tired of talking heads that don't give evidence or data to support their broad generalisations and opinions? Then you are ready for an Infographic Instant!Your narrator is Prof. Bryane Michael. Prof. Michael holds fellowships at Oxford, Columbia, Hong Kong U, and others. He has advised over 20 governments, over 500 companies on transactions worth over $50 billion, and taught over 800 executives. A Harvard and Oxford graduate, he is qualified to lead you through the tough issues of the day.

Episódios

-

Generation Z has little say in the financial infrastructure that will govern future generations

29/12/2023 Duração: 01h15minWe are building the new internet on the bones of the old. Like the early attempts to build airplanes using flappable wings. We take our grandfathers' understanding of law and economics - and try to apply it to Web3. In this podcast, I describe how a new set of laws and conventions could help us break out of the 'lock in' which keeps us using New Tech (blockchains, lithium-ion, artificial intelligence, tokens) like the wood and paper of old tech. I give examples of how FinTech could change the way we live. And how 70-80 year old men simple add-on to existing law. Like taking the law on horse-driven transport and replacing the word 'car' for 'horse' in the new law. Dumb. Yet, true.

-

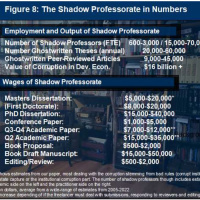

The Corrupt Institutions of Development Economics and Its Shadow Professoriate

17/08/2022 Duração: 26minMost of us use theories and empirical results from development economics all day long at the office. What if much of it led to under-development because of a shadowy group of advocates (or those who profess) benefit from bad theory and practice? I describe this Shadow Professoriate, the rules that keep it going strong, and their wages. I provide ball-park estimates of the harm they cause and how they cause this harm. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4188018

-

How To Find An Arbitrator For Your Cross-Border Dispute

20/04/2022 Duração: 11minAfraid to arbitrate a dispute because you don't want to spend thousands of dollars on lawyers? You don't need to. In this clip, I tell you everything you need to know about finding and hiring an arbitrator like me, the arbitration process and what you can expect to get out of it.

-

Why Do Economists Use Models?

15/04/2022 Duração: 19minWhy Do Economists Use Models? by Bryane Michael

-

How Can Public Procurement Law Affect FinTech?

02/12/2021 Duração: 25minGovernments are trying to procure innovative FinTech sectors. Yet, no one yet knows what such FinTech should look like. In our paper, we look at how to amend existing procurement law domestically and internationally. For the paper: http://ssrn.com/abstract=3976018.

-

Wanda Case Study: What Should Chairman Wang Do?

01/03/2019 Duração: 32minWanda Dalian Chairman Jian-Lin WANG had a decision to make. Should he, and Wanda by implication, compete with Disney aggressively, or do something else? What should the company's grand strategy be? And what is the role of the People's Republic's government in all this? This teaching video should help you with the issues behind the case study. Listen to the case study here -- and read it on the link below. Look at the YouTube video for pointers from the Teaching Note. And prepare to think about the major issues involved in the case. For advanced MBA and management students and executives following related courses. Case Study: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3169121

-

Writing Anti-Corruption Regulations When Laws Don't Work

29/03/2018 Duração: 09minAnti-corruption laws are generally failing all over the world. Can regulation -- rather than legislation - hold the answer to more effectively fighting corruption? In this 'how to' episode, we describe 10 years of research on writing these rules. We argue that these rules teach us about the way administrative law is evolving - and how anti-corruption law forms its own area worthy of study. For the papers we referenced, see: 1. Drafting International Regulations: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=995978 2. Designing a Preventive AC Agency: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1468957 3. Lessons from the OECD: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2250999 4. Auditing Anti-Corruption Regulations: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2226501 5. Foreign law giving a helping hand: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2270964 6. Ethics-related regulations: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2354630

-

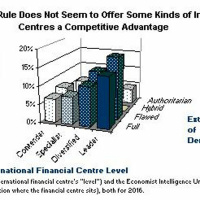

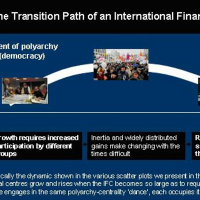

The Results about Polyarchy and Financial Centre Success

26/03/2018 Duração: 08minWe find that financial centres balance democracy and autocracy, depending on trends in other international financial centres. Democracy can encourage financial innovation. Yet, autocracy can encourage 'focus' and cost-saving measures. The question is not whether an international financial centre benefits from becoming more democratic -- but whether it benefits by becoming more democratic RIGHT NOW.

-

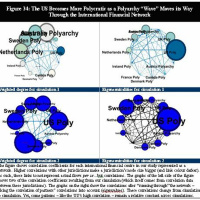

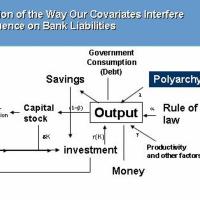

The Model and Econometrics of Polyarchy and Financial Centres

26/03/2018 Duração: 11minData do not speak for themselves. Only a model can help us make sense of the flood of data we see. Only econometric analysis helps us separate the signal from the noise. We review our model and the way we adjust global financial networks for distorting variables like the way economies shift over time.

-

What Data Say About Democracy and Financial Success

26/03/2018 Duração: 08minGlancing at the data may show that democracy serves as the best incubator for financial centre success. We show the data - before applying the usual adjustments and controls which rigorous scientists would apply to make the data more reliable. We show how autocracy plays a greater role than one might think.

-

Why Care about Democracy's Effect on International Financial Centres?

26/03/2018 Duração: 03minMany people see democracy as bad for developing an international financial centre. Qatar. UAE. Moscow. Istanbul. Jersey. Malta. Shanghai... the list goes on. We describe why the question holds extra relevance now in the Brexit and Hong Kong full reversion to Mainland authority - and review our findings.

-

Does Democracy Help Grow an International Financial Centre?

19/03/2018 Duração: 32minDoes democracy or autocracy political institutions best allow policymakers to grow their international financial centres? In this presentation, we show how these centres must respond to each other. Democratic inclusion in one place depends on another place. So does its centrality in the global financial system. We describe the importance of this question, tell what the data say, describe our view of the world and the way we must fix our data and finally present our results. Our research has implications from Brexit to Hong Kong post-2047... and everything in-between.

-

Why Should Central Banks Buy Private Securities as Part of Monetary Policy?

22/08/2017 Duração: 05minCentral banks conduct monetary policy mostly through government securities markets (ie they buy and sell government bills, bonds, etc.) -- when not directly tampering with interest rates. Why should governments buy companies' securities directly - rather than support banks to do this? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3023795

-

Which Central Banks' Private Securities Purchases Would Most Goose Investment?

22/08/2017 Duração: 10minWhich central banks' private securities purchases would contribute the most toward real investment in their jurisdiction(s)? Such monetary policy helps most when conventional monetary policy has failed (or will likely fail because of liquidity traps) and the executive part of government sags in corruption and incompetence. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3023795

-

Do Central Bank Private Asset Purchases Actually Encourage Real Investment?

22/08/2017 Duração: 06minEconometric evidence shows a pretty clear line between central bank unconventional monetary policy (outright purchases) and output - usually because of its effects via money policy mechanisms. What about its effects on real investment (like in DNA sequencers, 3D printers, IP patents and "real" investment)? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3023795

-

Should Central Banks Be Funders of Last Resort?

22/08/2017 Duração: 04minWould unconventional monetary policy aimed at buying private sector securities (stocks and bonds) helped boost lackluster investment? Particularly in developing and emerging markets? We look at the role that central banks - as funders of last resort - might have played in promoting investment. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3023795

-

Ballooning Central Bank Balance Sheets as Opportunity for Companies?

22/08/2017 Duração: 02minCentral banks around the world bought up alot of securities. To what extent have central banks turned to buying private sector securities in a macroeconomic environment characterised by zero percent interest rates, low growth, investment, and ballooning debts? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3023795

-

Central Banks as Funders of Last Resort: Intro and Findings

22/08/2017 Duração: 04minWhy can't central banks normally buy stocks and bonds from the private sector? What happens if/when they do? We introduce our subject, and quickly present our findings (that central bank purchases can promote investment under certain circumstances). For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3023795

-

Full Presentation: Central Banks' Securities Purchases' Effect on Investment

22/08/2017 Duração: 46minWhy don't central banks buy our companies' stocks and bonds? Should they fund mostly governments? And expand credit through banks? We look at central banks' role as a "funder of last resort." We find that investment increases when central banks buy private sector assets - except under a certain "sloth effect." We describe how law fails to give central banks the authority they need - and show how drafting a nominal GDP target objective directly into the central bank law helps promote investment and growth. For more: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3023795

-

Who Wins from the World-Wide Competition Law Copy-a-thon?

01/08/2017 Duração: 04minMost governments copied competition law "best practice" - without accompanying templates on improving innovation/productivity. Competition acts are easy to copy. New ideas are not. Some countries like Singapore and Hong Kong will win out from more competition. Vietnam and even Japan won't -- unless law incentivises creativity. To see how much money your country will win/lose, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3000240